The Opportunity Zones program encourages long-term investment and job creation in low-income areas of the state, by allowing investors to re-invest unrealized capital gains in designated census tracts. The state of Missouri submitted the 161 Opportunity Zones listed below to the federal government for inclusion in the program.

The provision has two main tax incentives to encourage investment:

- Temporary deferral of inclusion in gross income for capital gains that are reinvested into Opportunity Funds

- Investors can roll existing capital gains into Opportunity Funds with no up-front tax bill.

- If investors hold their Opportunity Fund investments for five years, the basis of their original investment is increased by 10 percent (meaning they will only owe taxes on 90 percent of the rolled-over capital gains.) If investors hold for seven years, the basis increases by a further five percent.

- Investors can defer original tax bill until December 31, 2026, at the latest, or until they sell their Opportunity Zone investments, if earlier.

- Excludes from taxable income capital gains on Opportunity Fund investments held for at least 10 years

Zones are subject to approval by U.S. Department of Treasury. A date for final approval has not been set.

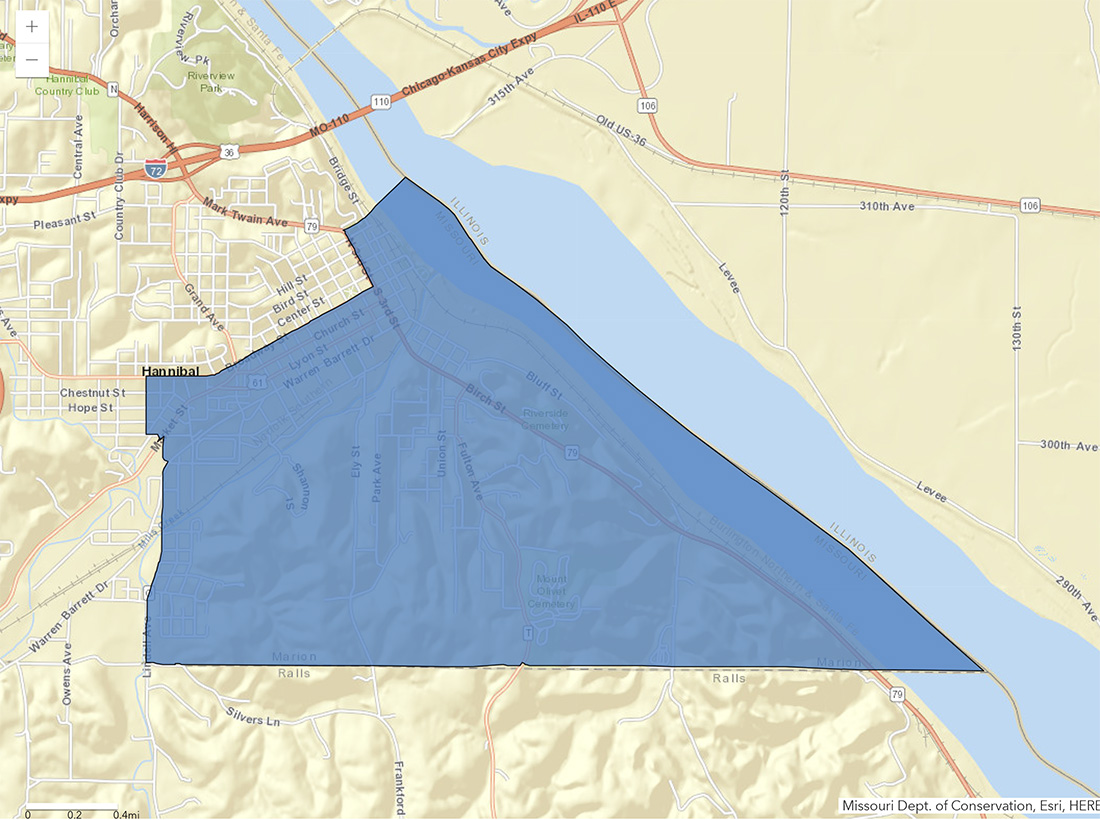

Hannibal OZ Tract Accepted by Missouri Department of Economic Development: